vitor-gaspar-cimf-via-flickr.png

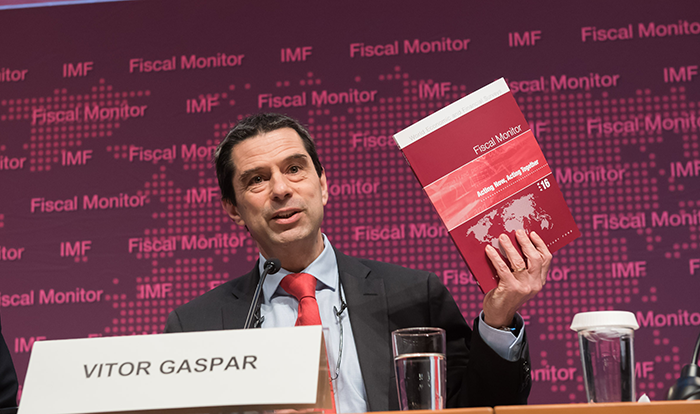

Vitor Gaspar, head of the IMF's fiscal affairs department. Credit: IMF

Speaking at a conference on tax in Japan this week, Vitor Gaspar, said that amid a lethargic but rapidly changing global economy, there is greater onus on fiscal policy to intervene.

“The global economy is undergoing major transformations,” he said, highlighting stubbornly slow productivity and unstoppable march of technology in particular.

“Fiscal policy is called [upon] to support sustainable and inclusive growth,” he continued. “At the same time, the high degree of uncertainty and stretched government balance sheets require a better management of fiscal risks.

“In other words, fiscal policy has the difficult task of achieving more and better within a very constrained envelope.”

However the IMF’s research shows this is possible, he stressed. Last year, his department’s bi-annual publication, the Fiscal Monitor, highlighted that tax policy can play an important role in stimulating research, development and innovation, fostering efforts to expand the technological frontier.

The upcoming issue of the monitor will focus on how fiscal policy can narrow the productivity gap between firms, Gaspar explained.

“Our analysis shows that countries can get very large productivity gains,” he said. “These come from reducing barriers that prevent capital and labour being allocated to the firms where they are most productive.”

Upgrading the design of tax systems to ensure they encourage decisions to be made on a business rather than a tax basis can have big productivity gains, he pointed out.

However, he added, domestic policies need to be “mindful” of the ripple effects they could have across borders.

Technological change also brings new opportunities for the design of tax policy, administration and spending.

“Digitisation is profoundly affecting the information base on which tax systems are built... [and affecting the ways of doing business,” he noted, stating it therefore has “strong implications” for tax systems.

“These are of relevance not only for advanced economies,” he explained. “To the contrary. We have seen examples of technological leapfrogging that point to great scope for progress in lower income countries.”

He said the IMF’s FAD has a “major project” underway with the Gates Foundation in this area, and will hold an event on the theme at the IMF’s Spring Meetings next month.