moneyworldmap_istock-182729540.jpg

Image © iStock

At S&P Global Ratings, we expect the global economic recovery to continue next year, stabilising the credit quality of our rated non-US local and regional governments (LRGs).

This recovery, which started in the first half of 2021, is reducing volatility and uncertainty caused by the pandemic.

Sufficient government support, especially in unitary countries, has also helped LRGs stabilise their finances.

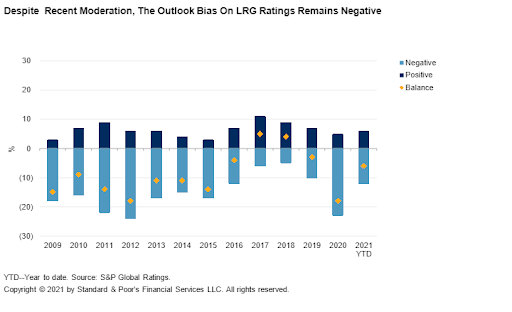

Currently, our ratings on LRGs show a moderate, but decreasing, negative bias: the share of LRG ratings on negative outlooks decreased to 12% from almost 23% at year-end 2020 (see chart 1).

Most of the negative outlooks on LRG ratings reflect the rising debt burdens of regional governments in federal countries that pursue expansionary fiscal policy, or mirror the outlooks on the related sovereigns.

On the other side about 6% of our ratings carry positive outlooks, suggesting a modest probability of upward rating movements next year, but this is close to pre-pandemic levels.

In 2022, potential upside triggers for our current assumptions could be improved revenue performance due to a faster expected economic rebound, higher intergovernmental and multilateral financial support, as well as strengthening related central government financial positions.

In our view, LRGs’ agendas will shift focus next year to adapt to the post-pandemic reality and longer-term issues, such as demographic shifts and decarbonisation.

Our assumption remains that LRGs in certain emerging markets, as well as regional governments in federal countries with advanced economies, will be more prone to downward pressure due to higher deficits and debt burdens than we currently forecast.

We believe that subnational governments will need to adjust their financial policies to a new reality in 2022, with both revenue and expenditure challenges.

We also anticipate that additional grants from central or regional governments will mostly be phased out next year, while tax revenue growth could be gradual amid weaker economic growth than we currently expect.

At the same time, inflation could make it more difficult to reduce social support measures and invest in infrastructure needs, which have been mounting due to subdued capital spending for years before the pandemic.

Disruption to global trade and supply chains has put upward pressure on prices worldwide.

We continue to expect inflation to be transitory but we believe downside risks are increasing.

Although inflation often accrues to LRGs’ benefit in balancing budgets, it can be a risk if rising wage pressure is not balanced by increasing tax revenue.

Medium-term infrastructure needs will likely put additional cost pressure on subnational budgets in most countries in the medium-term, and failure to address them will limit long-term growth potential.

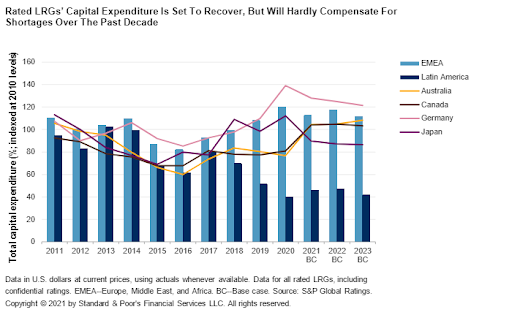

Moreover, LRG capital spending has been largely subdued over the past decade and is expected to increase, with the notable exceptions of China and India.

Although infrastructure investments increased during the pandemic in Europe (including Germany), Canada, and Japan, we expect many regional governments to scale back spending in real terms post-pandemic (see chart 2).

The large infrastructure backlog will also likely constrain subnational budget flexibility in Latin America.

The pandemic has also reshaped the landscape in ways that will have a lasting impact on LRGs’ credit quality.

One means is through accelerating digitalisation of business, markets, and government operations.

Digitalisation has also accelerated remote work, facilitated by increasing online capabilities.

Many local governments took advantage of the pandemic to strengthen digital collection capabilities, improving revenue collection even at a time when the tax base was flat or contracting.

At the same time, these digital capabilities expose more governments to the risk of cyber attacks.

In our view, large urban areas, particularly core cities, are likely to experience lower fiscal consolidation due to accelerated suburbanisation and lower demand for transport services and commercial and residential real estate.

This would double burden cities through a lower property tax base and higher subsidies to municipal companies.

Simultaneously, more remote areas of commuter belts could benefit from larger populations and greater demand for public services.

We also believe that lower-rated subnational governments in Argentina and Central and Eastern Europe will remain exposed to volatile lending conditions.