web-eucommision_9041616598_efb674cec6_o.jpg

A Palestine child holding UNWRA aid. Credit: European Commission

Other factors stemming from the UK’s vote to leave the European Union, such as increased risk aversion, will also have “major implications” for developing countries, the think-tank’s analysis published yesterday claims.

The ODI estimates that the 10% devaluation of the pound in the first week post-Brexit, coupled with lower GDP in the UK (estimated at 3%), will lead to lower exports by developing countries. For the least developed countries (LDCs), the ODI forecast that $500m worth of exports could be lost.

The UK and the EU represent 30% of LDCs’ trade, the ODI highlighted. While even countries that export only to the EU could be hit, countries like Bangladesh will feel the impact of Brexit much more deeply.

Fifty percent of Bangladesh’s exports go to the UK and EU. Belize, Kenya, Mauritius and Fiji are among the other developing countries likely to be heavily affected.

The value of remittances, which contribute far more to nations’ development and economy than other flows like foreign aid, will also decline with the pound, the ODI said.

It estimates the loss will be equivalent to $1.4bn of spending in developing countries, in particular Uganda, Nigeria, India and St Lucia which are among the most dependent on remittances from the UK.

“The devaluation will also reduce the value of aid by roughly $1.9bn,” the ODI’s report said. “The combined cost (through aid, trade, and remittances) of the devaluation is expected to be $3.8bn.

“If the pound continues to fall, the effects could increase.”

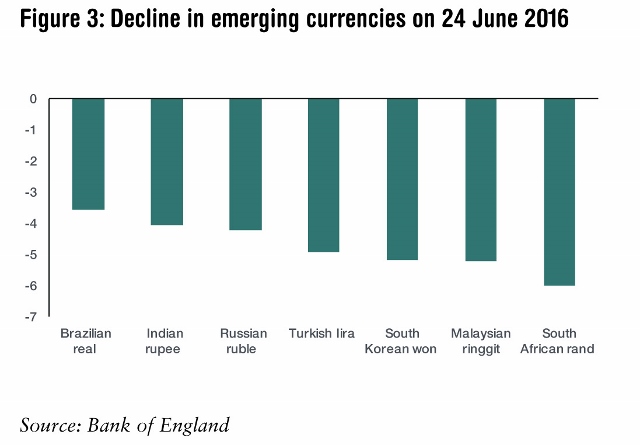

The leave vote sparked uncertainty and risk aversion, both of which are also likely to hit emerging and developing economies.

Already, the impact of risk aversion is becoming evident. Brazil, India, Turkey and South Africa have all seen their currencies decline as investors flock to ‘safe havens’ like the Japanese yen at their expense.

odi-5_640x445.jpg

Decline in emerging currencies on 24 June 2016. Source: ODI via Bank of England

In the long term, increased capital outflows are a “key risk”, the ODI said, as are reversals in UK foreign direct investments and higher borrowing costs.

However the ODI said that the longer-term impact on developing countries will depend on: new trade deals, forged by both the UK alone and the EU without the UK; the way aid and other development finance will be maintained and allocated; the impact on global collaborations; the reaction of financial markets; and the way immigration and remittances are maintained.

Some countries may even benefit from the fallout, with changes to the price of commodities like gold, the distribution of aid across different countries, a reduction in the price of imports from the UK and the ability to forge new trade deals presenting good opportunities for some nations.