In its first assessment of the world economy since Donald Trump won the US presidential election, the think-tank said that unless governments can resist moves to close off world trade, attempts to revive sluggish global growth will be futile.

Protectionism would also “likely raise prices, harm living standards and leave countries in a worsened fiscal position”, OECD chief economist Catherine Mann stated.

The election of Trump to the White House has sparked fears across the globe that his inward-looking policies, which include high tariffs for China and the abolition of key free trade deals, will smother already feeble trade growth.

Weak global trade – growing at around half of the rate seen before the financial crisis and below the rate of GDP growth – is thought to be one of the key reasons for the disappointing rate of global economic expansion.

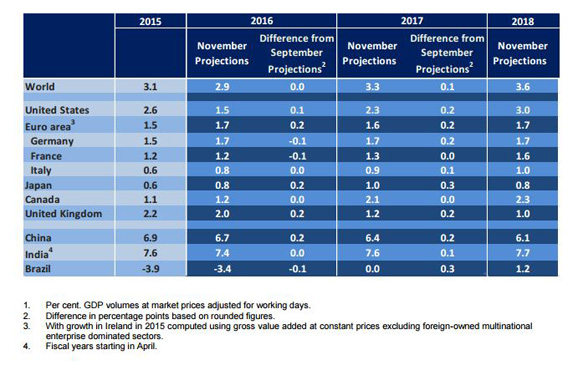

Its global growth forecast for this year remains unchanged at 2.9%, following a downgrade in September. It will then rise to 3.3% next year and 3.6% in 2018.

oecd_growth_forecasts1.jpg

GDP growth projections. Source: OECD World Economic Outlook Novemer 2016

Activity is expected to speed up in the US, where Trump’s plans to boost spending and cut taxes are likely to constitute a short-term growth injection.

The OECD expects the US economy to grow by 1.5% this year (unchanged from September’s forecast), before benefiting from a 2.3% boost in 2017 and then 3% the year after. It was predicting 2.1% growth for the US in September.

Trump’s plans to spend heavily on infrastructure line up with recommendations from the OECD and the International Monetary Fund, who have called on governments to make the most of ultra-low interest rates by ending spending restrictions and investing in high-quality projects.

The OECD emphasised this point again today, pointing to a “window of opportunity” for fiscal measures.

But this is not a “blank cheque” for governments, added Angel Gurría, OECD secretary-general. “The OECD is calling for fiscal policy to be used more wisely, with spending targeted at areas that boost growth, like high-quality infrastructure investment, innovation, education and skills, which also make growth more inclusive.”

This could push the global economy to the “modestly higher” growth rate of 3.5% by 2018 without increasing debt-to-GDP ratios in the long term, thanks to the “extraordinarily accommodative” monetary policies that have generated low interest rates, the outlook argues.

However, Mann warned that protectionism and the “inevitable trade retaliation” would “offset much of the positive effect” of such initiatives.

Trump is not the only politician in recent times to capitalise on public discontent around globalisation. The OECD didn’t single out any for their protectionist policy platforms, but stressed that all should avoid “trade pitfalls”.

The think-tank recognised the temptation to argue for a need to stem globalisation in order to protect workers who have lost their jobs, or have to endure lower wages due to overseas competition.

However, it stressed that while protectionism would shelter some, it would “worsen prospects and well-being for many others”. It noted that more than 25% of jobs in many OECD countries depended on foreign demand.

It also signalled that the UK’s decision to turn away from the EU and possibly the open single market is set to harm prospects. It revised its 2016 and 2017 forecasts up, to 2% and 1.2% respectively, as the economy proves its resilience to the initial shock of the EU referendum vote. However, it set the 2018 rate at just 1%, in line with the current consensus that the real impact will be felt much later.

The euro area saw a 0.2 percentage point boost in both years, with the OECD now expecting 1.7% and 1.6% growth respectively.

However, in many emerging market economies, growth is likely to falter further, it warned.