web_angola_istock_29726080_large.jpg

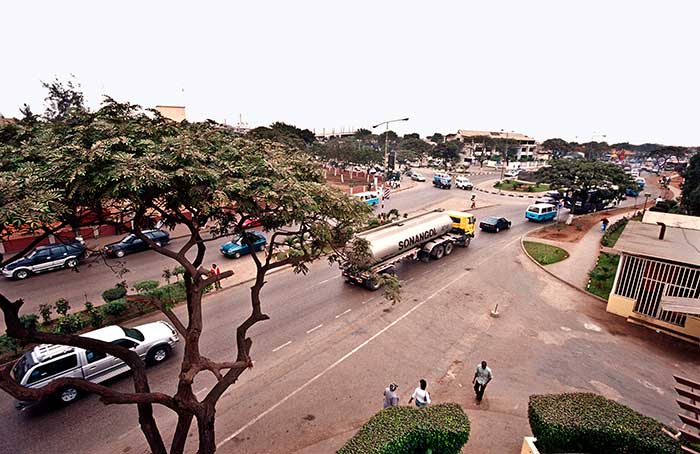

A truck from Angola's main oil company Sonangol. The crash in commodity prices has put oil-reliant economies like Angola under severe strain, weighing on sub-Saharan Africa's growth prospects

The warning comes after the International Monetary Fund stated in October that the region’s growth was at a 22-year low, pushed down by the constraints felt by many of the continent’s once-booming commodity exporters amid the collapse in prices.

Nations like Angola, Nigeria and South Africa have been under intense pressure this year as their commodity-reliant economies slowed drastically.

Fitch said that while commodity prices have regained some ground, exporting nations were still running substantial budget and current account deficits and are facing financing strains and pressures on foreign exchange reserves.

Such economies will need to raise taxes and cut spending further in 2017 to narrow deficits and stabilise their economies, it noted.

While the collapse in commodity prices pushed countries like Angola to revise budgets for 2016, elsewhere, namely in Nigeria, the government looked to finance a record budget deficit with increased borrowing.

The country is currently preparing to launch its first eurobond since 2013 to help plug the 2.2 trillion naira (currently around $7bn) gap in its budget, along with concessional loans from development banks.

Fitch also expects government debt ratios in the region to continue climbing, to an average of 52.3% of GDP in 2017.

The United Nations has warned that the chance of a fresh bout of sovereign debt crises in developing nations is rising as poorer states that borrowed heavily in good times struggle to weather lower levels of growth.

As well as the decline in commodity prices, Fitch pointed to heavy spending on infrastructure and “often weak public financial management” as key drivers of high budget deficits.

Elsewhere, political instability and a severe drought across much of the region have further weighed on its growth prospects.

The El Niño-induced drought was one of the worst to hit many countries in sub-Saharan Africa in decades, and has led to severe food crises and a spluttering economy in countries including Zimbabwe, Malawi and Ethiopia.

Ethiopia, along with a host of other nations in the region, also face political instability that threatens governments ability to tackle challenges and the confidence of foreign investors in many states.

Unrest in the country has led to the imposition of a state of emergency, meanwhile tensions are rising in countries like Kenya ahead of upcoming elections.

Fitch expects growth in 2017 to rise to 2.9% after an “exceptionally weak” 0.9% expansion this year, as some of these factors start to fade.

But new challenges look set to emerge too. The election of incoming US president Donald Trump has left many anticipating an interest rate rise by the country’s Federal Reserve bank next week, in response to Trump’s planned spending increase.

This could limit a key financing strategy for many African countries, researchers have warned, and make servicing debts in the region more expensive, compounding the effects of a strong dollar.