web_shinzo-abe_shutterstock_415949860.jpg

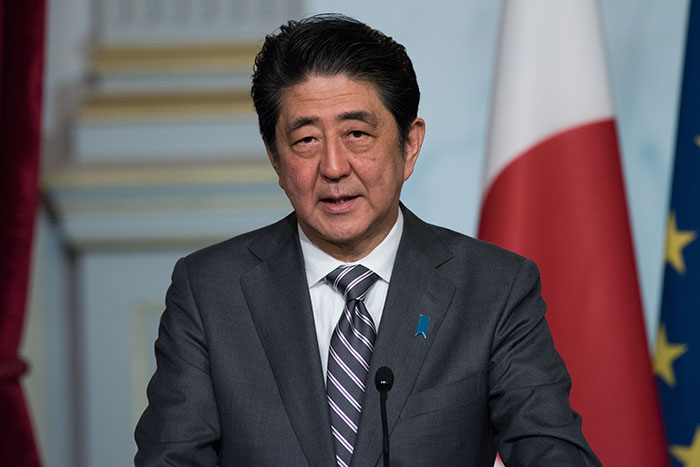

Japanese prime minister Shinzo Abe

Data published by Japan’s statistics bureau last week showed the country’s consumer price index (CPI) had fallen 0.3% over the year and 0.2% in December 2016 alone, compared with the same period a year earlier.

This was slightly better than an anticipated 0.3% fall that month, but still marked the tenth consecutive month of decline despite the prime minister Shinzo Abe and the Bank of Japan’s extraordinary efforts to prevent deflation.

The government and the central bank have implemented massive fiscal and monetary stimulus, including the unorthodox negative interest rates set by the BoJ last year, to rescue the economy from the twin plagues of deflation and low growth.

Today’s figures serve as yet another setback to Abe’s efforts to encourage households to spend more and his ambitious economic strategy – known as Abenomics – designed to kick start the economy.

Japan’s economy has now drifted yet further from the BoJ’s inflation target of 2%.

Analysts have noted that an upturn in oil prices and a weaker yen, thanks to the growing strength of the dollar since US president Donald Trump was elected, could see CPI bounce back later in 2017.

But Trump’s protectionist outlook, which has seen him withdraw the US from the Trans-Pacific Partnership trade deal, of which Japan was another key signatory, could signal further bumps in the road ahead for the Japanese economy.

For now, however, the country has posted its first annual trade surplus since 2011’s devastating tsunami ploughed into the Fukashima nuclear plant, forcing Japan to go elsewhere for its energy.

Hideaki Kikuchi, an economist at the Japan Research Institute, told the Japan Times that while prices may turn positive as commodity prices recover, “inflation is unlikely to rebound strongly for now”.

“Consumer spending is weak and wage hikes have slowed,” he noted