In the latest edition of its semi-annual Fiscal Monitor, published today, the IMF outlined how tax policies can limit the poor use of resources and bring the low-productivity elements of an economy up to speed, or, if necessary, remove them altogether.

Global productivity, one of the key drivers of growth and higher living standards, began its downward descent long before the global financial crisis. All kinds of economy have been affected, and all are struggling to revive its growth, leaving policymakers increasingly concerned.

The fund noted, however, that in each country there are some businesses that have managed to achieve high levels of efficiency, possibly even “close to those of the world frontier in their particular industry”.

It added that this “implies that existing conditions within the country can be compatible with higher levels of productivity”.

However, the report said badly designed economic policies and market failures, which prevent the expansion of efficient firms and promote the survival of inefficient ones, generate such wide variation in productivity levels across even narrowly defined industries.

Such policies lead to the poor use of available resources, for example by encouraging firms to make decisions for tax rather than business reasons, and affect some firms more than others.

In a blog on the topic, also published today, Vitor Gaspar, head of the fund’s fiscal affairs department, and the department’s deputy division chief of fiscal operations, Laura Jaramillo, highlighted one example – weak tax administration, which is problematic in developing countries in particular.

For instance, two firms that are largely similar aside from their tax behaviour – with one tax compliant and the other evasive – will allocate resources differently.

The compliant firm can only afford to make investments in high-return projects, while the tax-evading firm can withstand lower returns. If capital were to move to the fully taxed firm, with its better decision-making, overall productivity would increase.

Other tax policies that can foster similar distortions include taxes that discriminate by type of asset, sources of financing or firm characteristics such as formality and size. Governments should seek to minimise such differences in treatment and encourage business rather than tax-based decisions, the report said.

At the same time, policymakers should seek to level the playing field across firms, it continued, by lowering compliance costs and strengthening compliance.

productivity_growth.jpg

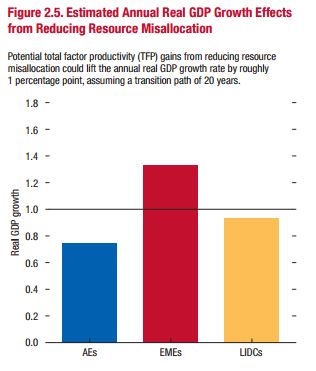

Potential addition to GDP growth rate as a result of increased productivity for advanced, emerging and low-income developing economies over 20 years. Source: IMF Fiscal Monitor Spring 2017

The fund’s analysis suggests this could add roughly one percentage point to annual GDP growth after 20 years, with the payoffs for emerging and low-income developing economies being larger than in advanced economies, where productivity is stalling the most.

“It is important to note that the reforms will have both winners and losers, and therefore the transition will need to be carefully managed,” it added.

“In some cases, the least productive businesses will need to exit the market, releasing resources for more productive ones.”