negative_debt.jpg

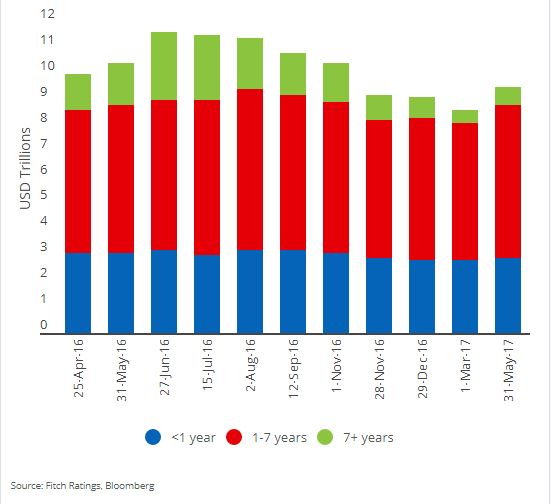

Negative-yielding debt by maturity. Source: Fitch Ratings

On 1 March, total negative-yielding debt stood at $8.6tn – the lowest it had been since 2016. This had increased to $9.5tn by 31 May.

Negative-yielding sovereign debt is debt that would cost the investor money if they held it to maturity, essentially meaning lenders are paying borrowers in order to borrow from them.

The existence of negative-yielding government bonds or other debt usually indicates investors are pessimistic, and would rather keep their money in safe investments, and lose some of it, than park it elsewhere, where they could lose more.

“Calming political fears related to the French election and a weaker dollar spurred the increase” in this case however, Fitch explained.

Heightened anxiety surrounding the French presidential election, which it was feared far-right Marine Le Pen could win, had driven investors away from French government bonds earlier in the year.

However in the run up to and following the victory of liberal centrist Emmanuel Macron at the start of May, interest in French sovereign debt has increased again, pushing up prices and lowering yields.

The amount of negative yielding sovereign debt in France rose to $1tn by the end of May, compared to $750bn on 1 March.

Another $400bn of the $900bn increase in negative-yielding government debt could be explained by changes in exchange rates between the euro and the dollar, and the dollar and the yen, Fitch continued.

“The amount of negative-yielding debt has been declining since November 2016,” its statement said.

“Higher yields have alleviated some pressure for investors but challenges remain, as yields in many developed economies are still near historic lows.”