The economic outlook of the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) region remained subdued as a result of the falling oil prices and regional conflicts, the IMF noted in a 'regional economic outlook' report.

The IMF said the continued reliance on oil and current high expenditures had pushed public debt to more than 50% of GDP in most countries.

This was especially true in the Gulf region, the IMF concluded, which has been hit by falling oil prices.

Economic growth of the countries in the Gulf Cooperation Council – a union of Arab states bordering the Arabian gulf, except for Iraq - would be at just 0.5% this year, the IMF predicted - the worst since the 0.3% growth in 2009 following the global financial crisis.

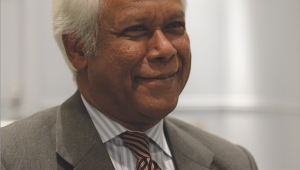

Jihad Azour, director of the Middle East and Central Asia department at the IMF, said: “It is the right time for GCC economies to accelerate their diversification outside oil and to promote a greater role for the private sector to lead growth and create additional jobs.”

He added that GCC countries should prepare for the “post-oil era”.

Countries should focus on improving their revenue collection and targeted spending cuts, while protecting social and growth-enhancing spending, the IMF outlook said.

It said: “All MENAP countries should take advantage of the window of opportunity provided by the strengthening global economy to implement job-creating reforms.”

Azour said: “Over the medium term, growth is anticipated to accelerate gradually in most MENAP economies, but it will remain below what is needed to tackle the high level of unemployment in the region and raise standards of living for all.”

Despite progress being made, countries should continue to focus on deficit reduction, as low oil prices have kept the fiscal deficit large in many oil exporter countries, the IMF said.

“But since oil prices are expected to remain in the range of $50-60 a barrel, oil exporters will need to sustain – and in some cases intensify – their budget deficit-reduction efforts,” the IMF country focus said.

The budget deficits jumped to 10.6% of GDP in 2016 from 1.1% in 2014. This is expected to halve in 2017 due to a modest recovery in oil prices and deficit reduction efforts.

Oil exporters overall growth is projected to reach a 1.7% low in 2017. In contrast, non-oil growth is expected to recover to about 2.6% in the same year as budget deficit reduction slows.

The IMF said: “In the current climate of strengthening global recovery, countries should also take advantage of international trade to support their economic growth.”

Earlier this month, the IMF told Timor-Leste to make its public spending more efficient as its oil resources are expected to run out in a few years.