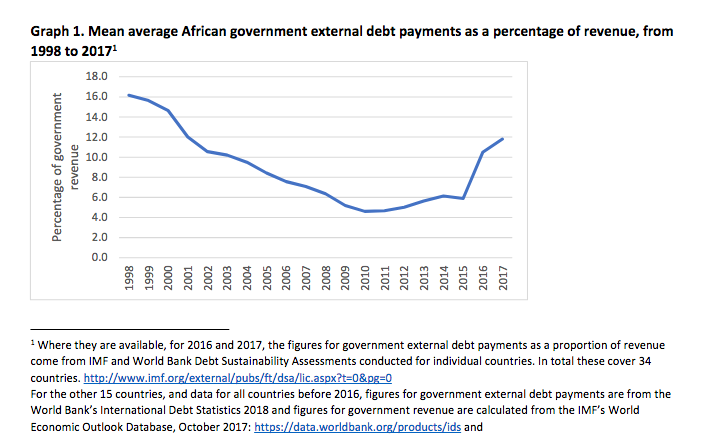

Increased lending since 2008, falls in commodity price in mid-2014 and rising US dollar interest rates saw the average African government external debt payments increase from 5.9% of government revenue in 2015 to 11.8% in 2017, the Jubilee Debt Campaign has said.

In its briefing, Africa’s rising debt crisis: who is the debt owed to?, which looked at 48 of Africa’s 54 countries, some states – such as Mozambique, Sudan and Zimbabwe – were already in ‘debt distress’ and others – including Zambia, Ghana and Mauritania – were at ‘high risk’ of struggling to pay their debts.

“African government external debt payments have increased dramatically in the last few years,” the analysis, released on Monday, said.

“This means African government debt payments are at the highest level since 2001.” [See graph at the bottom].

The analysis used data from the IMF, World Bank and John Hopkins University.

It found loans to African governments from external lenders amounted to $460 billion between 2006 and 2017.

African governments owed $130 billion of debt owed to other countries by the end of 2016, the Jubilee Debt Campaign said.

By the end of December 2017 they owed a total of $417bn. Of this, $100bn (24%) was owed by African governments to the Chinese government and $40bn (10%) to the ‘Paris Club’ governments – an informal group of official creditors, including 22 countries.

The charity also found that at the end of December 2017 African governments owed $66bn (16% of the debt) to the World Bank, $18bn (4%) to the IMF and $61bn to other multilateral institutions (15%).

Up to $132bn was owed to the private sector (32%).

The campaigning group called for international lenders, which are congressing at International Monetary Fund and the World Bank meetings this week, to come up with new lending rules and to reduce debts.

Tim Jones, economist at the Jubilee Debt Campaign, said: “We need new rules to make all lenders publicly disclose loans to governments at the time they are given.

“Furthermore, the IMF needs to stop responding to debt crises by giving loans which bailout other lenders, from China to Western companies, incentivising them to continue lending recklessly. Instead, lenders need to be made to restructure and reduce debts.”

The Jubilee Debt Campaign is a UK charity working to end poverty caused by debt.