Although not a new concept, 'blended finance' – or the use of public funds to de-risk or leverage private investments in development – has been attracting increased attention in development circles. Proponents are very optimistic about its potential to plug a funding gap - estimated at between US$1.9 trillion to US$3.1 trillion per year – in programmes to reach the Sustainable Development Goals. Fundamentally however, discussions around investments in blended finance, and the decisions arising from them, have been based on very little evidence.

Data and information on blended finance deals, both in terms of volumes invested and results on the ground, is sparse and often not public. Further, in our recent research we found that when information is publicly available, it tends not to be comparable across organisations or particularly comprehensive.

This lack of clarity is not necessarily deliberate, but is an outcome of reporting based primarily on internal needs and an absence of incentives for consistent reporting practices across institutions. This hinders our understanding of the role and potential of such financing alongside other resources for ending poverty and contributing to sustainable development more broadly.

The opportunity to address such incentives is now emerging as official development assistance (ODA) is increasingly considered as a potential source of public investment to scale up blended finance. Donors need to know that every aid investment it makes has a net positive contribution to poverty reduction and development. Similarly, donors need to be confident that any use of ODA for leveraging private finance results in a net increase in resources tackling poverty and supporting growth that benefits those most in need. This requires accountability of investments and evidence of impact. Without such knowledge, scarce public resources are at risk of being increasingly directed to blended finance activities without a thorough understanding of how and where blended finance can be deployed most effectively, or of what its comparative advantage may be within the increasingly complex financing landscape that developing countries face.

Enhanced transparency and accountability are critical next steps before investments in blending are scaled up, and this is going to require a lot of effort and commitment. Current data on blended finance deals doesn't allow for investments – both public and private – to be accurately quantified, let alone traced. Data limitations are compounded by the complexity of some blended finance set-ups which can involve a series of intermediary steps, such as blending facilities used to pool funds from different actors, or funds of funds managed by third parties.

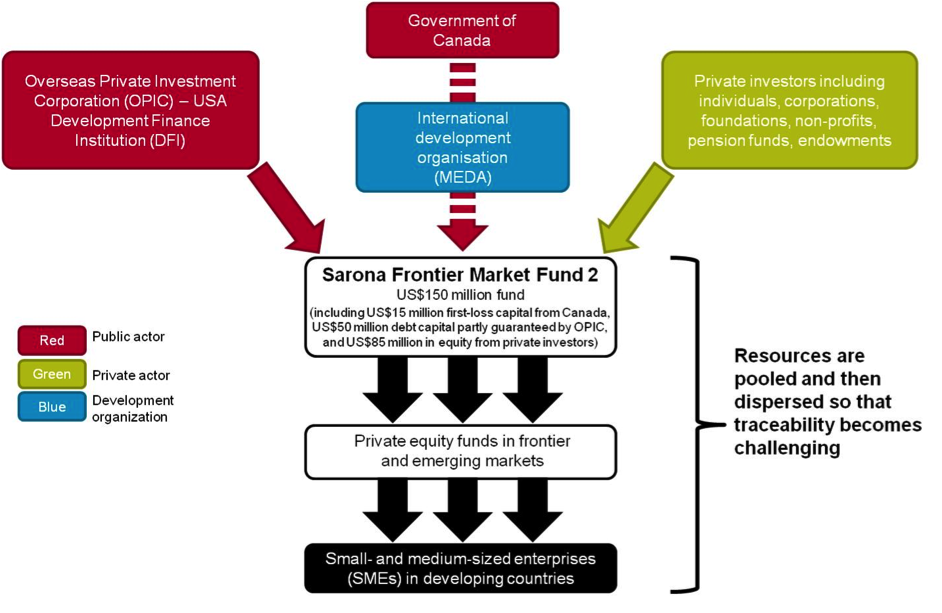

For example, the well-known Sarona Frontier Markets Fund 2 (SFMF 2) is an investment fund managed by the asset management company Sarona, which pools resources from a variety of investors – including public and private actors – and invests in emerging markets' private equity funds. These in turn invest in small and medium-sized enterprises in developing countries.

The SFMF 2 set-up illustrates how tracing investments from individual providers to the 'recipients' of blended funds can be highly problematic.

sfmf_2.png

Source: Development Initiatives (2016), Blended finance: Understanding its potential for Agenda 2030 (http://devinit.org/#!/post/blended-finance-understanding-its-potential)

Yet traceability is vital for effective decision-making on resource allocation for two reasons. Firstly, increased traceability means enhanced accountability – both at the local and international level – which in turn strengthens legitimacy, mutual trust and ultimately enhances results. Taxpayers and other stakeholders in donor countries should be able to assess where public money goes once it leaves donors' bank accounts, what other funds it is pooled with, what projects are being funded. Local stakeholders in developing countries – from governments to civil society – should also have access to this information, as well as know who all the actors involved in specific blended projects are, and the volumes provided by each investor.

Secondly, traceability is essential for assessing impact. Without such knowledge we cannot understand which investments from specific actors are contributing to positive development outcomes at the country level, how they are contributing, and who is benefiting. Some donor agencies have explicit mandates around poverty reduction, but the current lack of transparency and the difficulties in tracing investments through complex blended finance structures mean that compliance with such mandates cannot be known.

In order to maximise the use of blended finance in the context of the SDGs, a common reporting standard needs to be established. This should build on the lessons learned and the groundwork done by actors who have worked to improve transparency in development finance. The International Aid Transparency Initiative (IATI) offers one existing data standard that can provide a robust starting point to improve the evidence base on blended finance. It enables disaggregated, timely and transparent data, enhancing traceability investments. Some key actors are already publishing to IATI and others are looking to do so in the near future.

We should not shy away from harnessing the potential of blended finance, but much better data and information on investments must be the prerequisite to doing so.