Last week the IMF published its fiscal monitor: managing public wealth focusing on the public sector balance sheet (PSBS).

As an accountant it was great to read about the public sector balance sheet and see the IMF bring this into wider discourse.

But what is it and importantly, why does it matter?

The public sector balance sheet highlights the need to look at both assets as well as liabilities.

Traditional measures of government and/or public sector tend to focus on debt, typically assessing it as a percentage of GDP.

But this is only half the picture, which leads to sup-optimal decision making and poor public financial management; we need to look at what the public sector owns as well as what it owes.

The IMF identify 4 key benefits of the public sector balance sheet:

- Public Sector assets can be material; estimated to be $102 trillion globally or equivalent to 3% of GDP if these assets are better managed

- Balance sheet strength matters: this can result in lower financing costs, the recessions are shallower if the government has better finances and recovery from a recession is quicker

- Aids transparency to fiscal policy making and

- Facilitates deeper risk assessment.

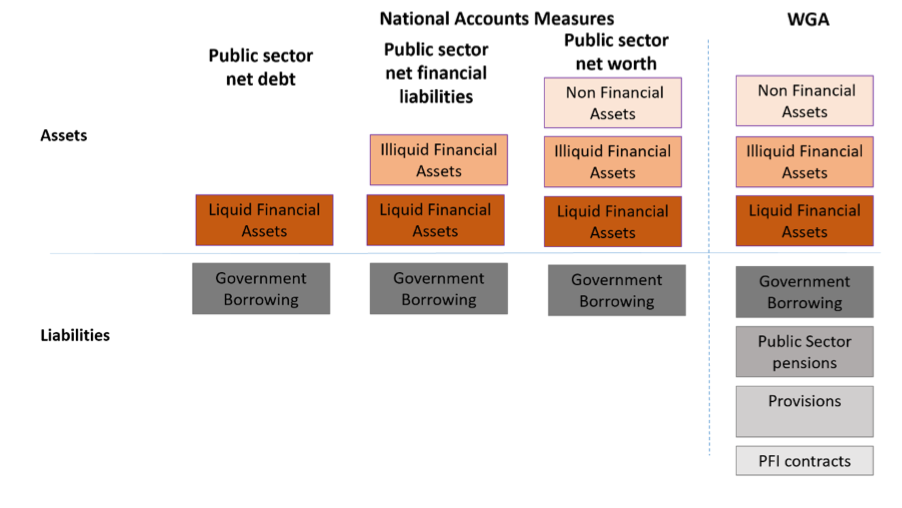

But the IMF PSBS is based on government financial statistics, prepared in accordance with the UN System of National Accounts (SNA) that are a statistical measure and not based on international accounting standards. Therefore, the information is not as complete as it could be.

The difference is clear to see in the reconciliation provided in the UK Whole of Government Accounts, consolidating over 7,000 government entities (including central and local government, health, schools and public corporations).

Given the enhanced information available when using international accounting standards, it is not surprising that so many countries have, are in the process of, or have stated their intention to applying internationally recognised accounting standards, primarily International Public Sector Accounting Standards (IPSASs).

In fact, recent PwC research identified approx. 71% of countries are moving to accrual implementation by 2025, up from 31% in 2015. This marks a huge shift in a relatively short time frame.

IPSASs are developed by the International Public Sector Accounting Standards Board (IPSASB), celebrated 20 years in 2017, following due process, including input from an independent Consultative Advisory Group and oversight from the Public Interest Committee (IMF are part of the PIC).

The recent IPSASB strategy and work plan 2019-2023 consultation, sought views on themes and key areas to prioritise – including natural resources which can be material for many countries

The wider debate should be how to make better use of the information in the government balance sheet. As ever New Zealand leads the way, and the benefits are clear, as set out in Ian Ball’s analysis.

In the UK the Chancellor announced a review of the government balance sheet at the Spring Statement 2018 and the report will be published in the autumn Budget, due to be held on 29th October.

This is not the only example where the balance sheet is influencing decision making.

When the first WGA was published, for the first time there was a clear view on government assets and liabilities.

The overall position was net liabilities (liabilities were higher than assets) and a major contributor is public sector pensions liabilities.

Since then, public sector pension schemes have changed to CPI rather than RPI and career average rather than final salary, showing how government is using balance sheet information to inform policy decisions.

The IMF are to be commended for starting the discussion but we need to be careful in the terminology – the IMF PBSB is the based on economic standards and not internationally recognised accounting standards.

However, the IMF figures are based on sector classification, not on ‘control’ (as defined in the accounting standards). Therefore an IPSAS based balance sheet might omit local government where the IMF figures would include them.

A PSBS covering all public sector entities and based on IPSASs should be used to drive better public financial management and assess good use of public assets, effective management of liabilities and assess impact of current policies on the long term sustainability of public finances, so that jurisdictions can course correct as necessary.