Pensions, education, healthcare, better infrastructure, technology, and climate change: fiscal policymakers have their work cut out for them on many fronts. Whether you live in a rapidly aging advanced economy, or a low-income or emerging market economy with a young, booming population, all these issues matter for you.

As the IMF Fiscal Monitor in April 2019 shows, government policies on taxes and spending have to adapt and should shift to growth-enhancing investment. This means, for example, more money to build classrooms, hospitals and roads, while cutting wasteful spending, such as inefficient energy subsidies.

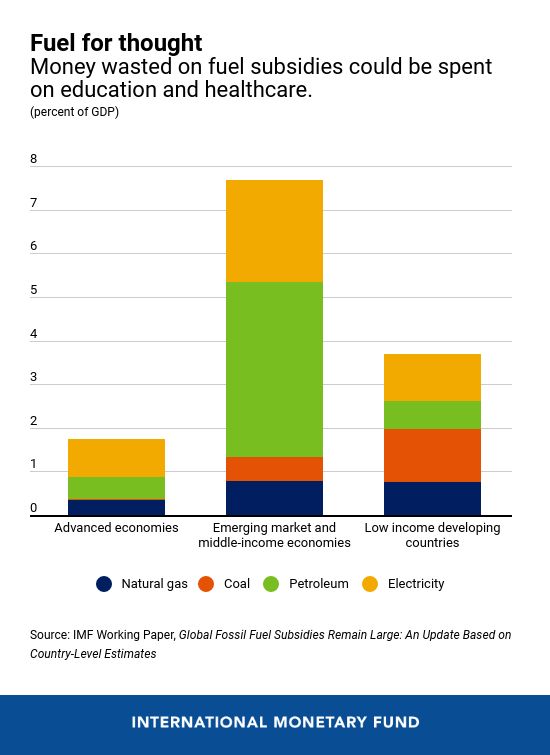

'Removing fossil fuel subsidies, which typically benefit the rich more than the poor, could gain up to 4% of global GDP.'

IMF’s chart [below] shows that removing fossil fuel subsidies, which typically benefit the rich more than the poor, could gain up to 4% of global GDP in additional resources over the medium term to invest in people, growth, and help protect the most vulnerable.

The IMF define the subsidies - which amount to 6.5% of GDP globally - broadly. The fund’s calculations include both the government funding to artificially reduce the price of energy below cost (0.4 % of global GDP) and the under taxation of fuel consumption (6.1% of global GDP), because energy consumption contributes to global warming, local pollution, increased traffic congestion and more accidents.

This money spent on other priorities can help raise long-term economic growth, which is a key ingredient to reduce the burden of high public debt. It can also spread economic benefits more widely within and across countries and help restore the public trust in institutions necessary for economic stability.

In October the IMF will publish the next Fiscal Monitor that will focus on climate change.