-

12 Jul 22

Officials at the OECD have set a deadline of this time next year for global agreement on one part of its landmark tax reforms, agreed in principle by the vast majority of the world’s countries last...

-

20 Jun 22

The Hungarian finance minister has vetoed the European Union’s adoption of a 15% effective minimum corporation tax rate, representing the latest setback to the implementation of the already-delayed...

-

26 May 22

The head of the OECD has admitted progress on the organisation’s much-vaunted global tax shake-up has fallen behind, and will not now be implemented until at least 2024.

-

12 May 22

OECD countries are close to meeting just a quarter of measurable targets under the United Nations’ Sustainable Development Goals, with the 2030 deadline looming.

-

12 Apr 22

International aid rose to a record $179bn in 2021 as developed countries increased their efforts to help their developing counterparts deal with the Covid-19 pandemic, OECD figures have shown.

-

18 Mar 22

The economic damage caused by Russia’s invasion of Ukraine could take more than one percentage point off global GDP growth this year, according to the OECD.

-

23 Feb 22

The Mexican government’s finances have remained sound since the onset of Covid-19 but the government needs an “ambitious” set of reforms to cement the economic recovery, the OECD has said.

-

14 Feb 22

Government spending earlier in the Covid-19 pandemic has helped Colombia weather the economic storm better than many of its peers, but more needs to be done to make the growth sustainable, according...

-

27 Jan 22

The OECD is set to open accession discussions with Argentina, Brazil, Bulgaria, Croatia, Peru and Romania, over potential membership of the organisation.

-

20 Jan 22

A new portal launched by the OECD seeks to provide transparency over which of its development aid services are exempt from taxes, to avoid potential disputes.

-

14 Jan 22

Slovakia’s low Covid-19 vaccination rate poses a huge short-term risk to its economy, but the longer-term challenge of its fast-ageing population also needs attention, according to the OECD.

-

21 Dec 21

Canada’s decision to implement its digital services tax in 2024 if global reforms stutter has concerned the US administration, which has threatened to look again at its trade agreements with its...

-

3 Dec 21

Japan’s economic rebound from Covid-19 would be buoyed by spending to boost the country’s digital transformation, according to the OECD.

-

1 Nov 21

Emerging economies need greater access to financial assistance to help prepare for natural disasters brought on by climate change, according to the OECD.

-

1 Nov 21

Leaders of the 20 largest economies have endorsed a global deal that will see large multinational companies taxed at least 15%.

-

21 Oct 21

Pressures unrelated to Covid-19 are likely to have a bigger impact on public finances than the huge debt taken on by governments to tackle the pandemic, according to analysis by the OECD.

-

11 Oct 21

Multinational companies will be subject to a tax of at least 15% on their profits from 2023 after major reforms of the international tax system were finalised by 136 countries.

-

22 Sep 21

Irish leaders have spoken less harshly than usual about a planned global shake-up of corporation tax, which would see them raising the rate on the many large multinational companies with headquarters...

-

21 Sep 21

Economic recoveries from Covid-19 slowed in advanced economies over the past three months, as employment and supply chain issues caused uneven global growth, according to the OECD.

-

14 Sep 21

High-spending European governments managed the Covid-19 shock “very well”, despite suffering the worst recession in the EU era, the head of the OECD has said.

-

12 Aug 21

The pace of larger economies' economic recovery from Covid-19 has slowed in recent months, according to analysis for the OECD.

-

2 Jul 21

A “historic” agreement on corporation tax between 130 countries and territories will increase global public revenues by around $150bn according to the OECD, which led the negotiations.

-

1 Jun 21

Continued progress on international vaccination programmes and large stimulus packages mean the OECD's global outlook for economic growth year has been revised up by more than 30% on previous...

-

28 May 21

African countries have been urged to step up cooperation on tax to raise money needed to support their economies through the economic crisis caused by Covid-19.

-

21 May 21

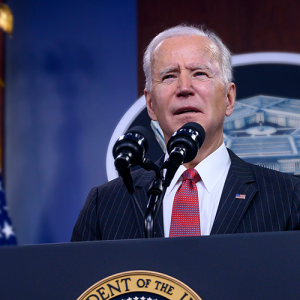

Joe Biden’s administration has climbed down from its proposed 21% minimum tax rate for multinational companies, suggesting it could accept a compromise as low as 15%.