-

7 Jul 23

The Turkish government is set to hike corporation taxes and vehicle duties to help fund the reconstruction costs from devastating earthquakes earlier this year.

-

11 Apr 22

Poland has blocked the European Union’s effort to adopt a minimum corporate tax rate agreed by 137 countries last year over concerns the move would risk making the tax system less fair.

-

1 Nov 21

Leaders of the 20 largest economies have endorsed a global deal that will see large multinational companies taxed at least 15%.

-

11 Oct 21

Multinational companies will be subject to a tax of at least 15% on their profits from 2023 after major reforms of the international tax system were finalised by 136 countries.

-

22 Sep 21

Irish leaders have spoken less harshly than usual about a planned global shake-up of corporation tax, which would see them raising the rate on the many large multinational companies with headquarters...

-

13 Sep 21

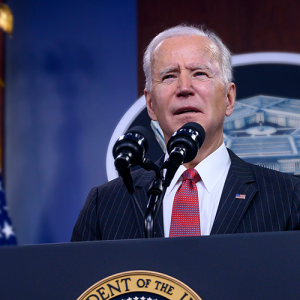

US Democrats are looking to raise the country’s corporation tax rate to 26.5% to fund president Joe Biden’s spending plans.

-

2 Jul 21

International reforms of corporation tax could have “serious implications” for Ireland’s public finances, a report from the country’s central bank has warned.

-

2 Jul 21

A “historic” agreement on corporation tax between 130 countries and territories will increase global public revenues by around $150bn according to the OECD, which led the negotiations.

-

15 Jun 21

Muhammad Afnan Alam explores the G7 commitment to push for at least a 15% global minimum rate of corporation tax.

-

7 Jun 21

A global minimum corporate tax rate of 15% has been criticised for failing to end the incentive for multinational companies to book profits in low-tax countries.

-

21 May 21

Joe Biden’s administration has climbed down from its proposed 21% minimum tax rate for multinational companies, suggesting it could accept a compromise as low as 15%.

-

20 May 21

The European Commission has unveiled plans to reduce corporate tax competition between EU countries with a single rulebook for the whole bloc, but could face opposition from certain member states.

-

18 May 21

The UK is hesitant to support the US push for a 21% global minimum corporation tax rate over fears doing so would harm the chance of sorting out the issue of digital taxation, it has been reported.

-

22 Apr 21

Joe Biden’s suggested global minimum corporation tax rate would be unfair on small nations such as Ireland, the country’s finance minister has said.

-

7 Apr 21

A worldwide agreement on taxing multinational companies appears closer after the US signalled its support for a minimum global rate of corporation tax, European finance ministers have said.

-

29 Jan 21

The new US administration is likely to cooperate with other countries in finding a solution to the issues around international corporation tax, German finance minister Olaf Scholz has said.

-

5 Nov 20

A rare drop in corporation tax receipts in Ireland shows they cannot be relied upon in the future, the Irish finance minister has said.

-

26 Oct 20

“Unfair” global tax rules mean 20 developing countries miss out on as much as $2.8bn in tax from just three companies, campaigning organisation ActionAid has said.

-

14 Oct 20

Ireland expects its corporation tax yield to rise again this year, despite the backdrop of the global recession caused by Covid-19, an official document has revealed.

-

5 May 20

Efforts to fix the perceived problems posed by big digital businesses to the global tax system remain on track despite the Covid-19 pandemic, the OECD has said.

-

10 Mar 20

Multinational companies could make a “significant contribution” to the sustainable development of many economies around the world if their profits and taxes were more transparent, according to a...

-

19 Feb 20

The US could scupper global efforts to reform corporation tax, the official responsible for the EU’s tax policy has warned.

-

14 Feb 20

OECD proposals to shake-up the global corporation tax system do not adequately address the problem of tax avoidance by multinational businesses, a campaign group has warned.

-

21 Jan 20

The global tax system needs to be reformed to help address huge levels of inequality, a campaign group has said.

-

4 Dec 19

Ireland is on track for record corporation tax receipts this year, although the finance minister has warned the surge will not last forever.