-

11 Oct 16

Integrated reporting has a key role to play in Malaysia’s economic transformation, the country’s deputy trade minister has said.

-

7 Oct 16

United Nations human rights experts have urged governments to eliminate tax secrecy and offshore tax evasion after a fresh tax leak named the directors of several secretive firms in the Bahamas.

-

29 Sep 16

Building staff capability and capacity globally will be key if countries are to adopt accruals-based accounts that comply with international standards

-

16 Sep 16

Pakistan has become the latest nation to sign up to the OECD’s international cooperation initiative to combat tax avoidance and evasion, the think-tank has announced.

-

16 Sep 16

The European Commission has compiled a list of nations that could one day find themselves on the first common European Union blacklist of countries that do not adhere to good tax practices.

-

15 Sep 16

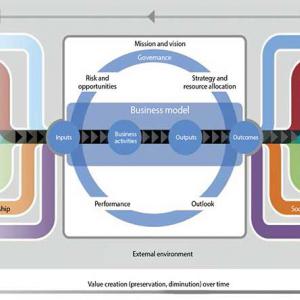

Integrated reporting can help deliver improved service outcomes at a time when austerity and tight budgets are weighing on public sector organisations across the world, according to a joint report by...

-

13 Sep 16

The US Securities and Exchange Commission should require greater tax disclosure from multinational companies in order to protect investors as well as the public, according to the Financial...

-

9 Sep 16

The eurozone’s finance ministers have called on all euro area member states to actively use spending reviews to improve the quality of public finances.

-

5 Sep 16

The International Integrated Reporting Council has appointed Richard Howitt, a member of the European Parliament for the UK’s Labour Party, as its new chief executive.

-

1 Sep 16

G20 leaders should champion stronger governance and public financial management following the upcoming summit in Hangzhou, China, according to the International Federation of Accountants.

-

1 Sep 16

Ahead of this weekend’s G20 summit, the International Federation of Accountants is calling for a host of accounting issues to rise higher up the global agenda

-

31 Aug 16

The US government forwent $1.23 trillion in revenue last year, yet nowhere is this reflected in the federal government’s financial report. A FASAB-proposed accounting standard aims to change...

-

30 Aug 16

Over 100 countries are now participants in an OECD international cooperation initiative to combat tax avoidance and evasion, the think-tank has announced.

-

24 Aug 16

The European Commission has weighed in on a Greek political row surrounding accusations that the former head of the country’s official statistics authority falsified official data, underpinning...

-

16 Aug 16

A major Ukrainian effort to stem official corruption and thus unlock the next tranche of IMF bailout funds got off to a difficult start after campaigners highlighted systemic loopholes and condemned...

-

4 Aug 16

An all-party parliamentary group in the UK has claimed the international proposals to combat global tax evasion do not go far enough and may create new loopholes that could be used to avoid paying...

-

29 Jul 16

IPSASB has updated its accounting standard covering employee benefits, it was announced on Thursday.

-

28 Jul 16

Switzerland is one of ten countries said to have made sound progress toward greater tax transparency in recent years, according to the OECD.

-

28 Jul 16

IPSASB has launched a consultation seeking views on how to account for currency in circulation, monetary gold and International Monetary Fund quota subscriptions and its special drawing rights.

-

14 Jul 16

It may not always be possible to implement best public financial management practice in some of the most fragile states in the world, an overseas development expert has told CIPFA’s annual conference...

-

6 Jul 16

The European Commission has announced plans for further measures to clamp down on tax avoidance and secretive companies in response to the publication of the Panama Papers.

-

4 Jul 16

European Union aid for refugees in Africa may be “too expensive”, according to a report from the European Court of Auditors.

-

1 Jul 16

More than 80 countries convened in Kyoto, Japan yesterday to discuss global efforts to prevent corporate tax avoidance and evasion as part of the OECD’s BEPS project.

-

15 Jun 16

It is not yet time to implement public country-by-country reporting for multinational firms or public registers of beneficial ownership, the director of the OECD’s centre for tax policy has argued.

-

6 Jun 16

International efforts are underway to develop and strengthen Professional Accountancy Organizations and public sector finance training