Last week, the International Monetary Fund announced a grim economic outlook for the world, predicting that the global economy will likely suffer the worst financial crisis since the Great Depression—with a global economic contraction of 3% in 2020 alone.

Governments are taking swift action to tackle the unprecedented combination of major simultaneous public health and economic crises. Among the G20 revenue and expenditure measures have totalled on average 3.5% of GDP, with further loans and guarantees totalling an additional 10% of GDP in some countries. While interventions have varied, there has been a concerted effort to get cash and resources to where they are most needed—quickly.

The scale of these interventions means that the pandemic will also have profound and long-lasting impacts on government finances, the ramifications of which will need to be thoroughly analysed. This is important to everyone, since government finances are already a significant part of each country’s economy, and this will increase following the crisis. High-quality financial reporting helps ensure that all stakeholders, from everyday taxpayers and recipients of government services, to policy makers, businesses, and investors, receive reliable and transparent information about their government’s activities. It also results in increased economic stability and greater societal trust—two things the world desperately needs right now.

Many of the current economic debates are over how long and deep the looming recession will be, and the extent to which government interventions will minimise economic ‘scarring’ through job losses and business and personal bankruptcies. These macroeconomic impacts will inevitably have both short and longer-term consequences for future government revenues. However, there is a myriad other questions about the detailed financial impacts of Covid-19 related government interventions. Only high-quality financial reporting can provide the full answers required for good decision-making.

The IMF called last week for governments to ‘do whatever it takes but keep the receipts’. They must go further and prepare accounts using these.

Unfortunately, unlike in the private sector, high quality accrual-based financial reports are not a tool currently available to many governments around the world. In 2018, only 25% of the governments reported using accrual-based accounting, though this number is predicted to rise to 65% in the coming years. .

Using the analysis provided by the IMF, key questions about the impact of the broad–ranging fiscal measures being implemented by governments include:

- Are the payments made to support businesses—for example to ‘furlough’ staff—irrecoverable current expenditure or are they potentially recoverable? If so, what proportion will be recoverable, and over what period?

- Should tax measures, such as delayed payment dates, be recorded as normal, albeit longer-term receivables? Or will there be permanent revenue losses as business insolvencies increase?

- What is the nature and scale of the various government guarantees being provided? Does the support provided for some organisations mean they are now state owned?

- What is the relationship between the government and its central bank, and how should additional ‘quantitative easing’ be reported?

These are very real, and highly material, questions to which conventional debt-based economic indicators can only give partial answers. The International Public Sector Accounting Standards (IPSAS) that the International Public Sector Accounting Standards Board (IPSASB) has developed - the equivalent of the private sector IFRS that the majority of listed companies globally use, can help provide more complete answers to these.

Any real economic comparators for the impacts of the pandemic date back to the Second World War. And even then, the economic shift was not as rapid we have seen with Covid-19.

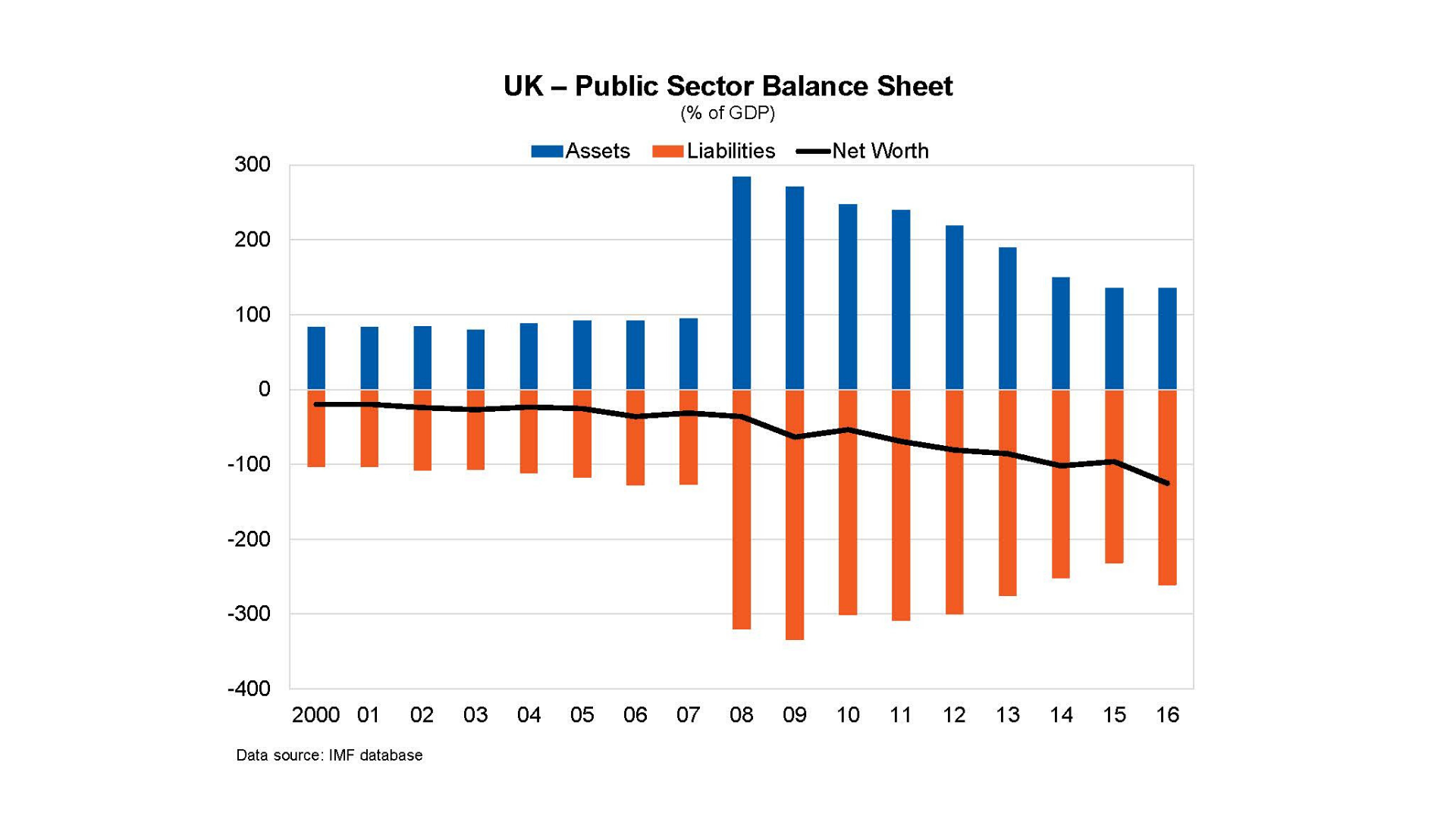

Another point in time that bears some similarities—the 2008 global banking crisis—had smaller and more concentrated impacts than are likely to result from Covid-19. An idea of the extent of what is to come, however, can be seen in the UK government’s consolidated public sector accounts. During the banking crisis, the government was forced to acquire significant parts of the financial sector. This caused an ‘explosion’ in both sides of its balance sheet, which has even now not been fully unwound as the timeline shows.

Covid-19 will undoubtedly have even larger, more complex, and more long-lasting adverse impacts around world, which will vary significantly between countries. Policymakers, international institutions, and markets need comparable financial reports to make sound decisions. Achieving comparability in government financial statements will require globally applicable financial reporting standards that address public sector needs. These should form an integral part of the coordinated measures and collaboration between global standard setters and multilateral institutions that the B20 calls for in its Statement on Trade and Finance.

At this stage in the pandemic, improving government accounting may not seem a high priority, but it could truly be a lifesaver. By providing the complete picture of the state of a government’s finances necessary for strong future fiscal projections, high-quality financial reports based on international accounting standards can help politicians make the right long-term choices for their countries that will be even more essential in the demanding post COVID-19 world. They can also help convince potential funders that they should provide the support required to implement them.

The IMF called last week for governments to ‘do whatever it takes but keep the receipts’. This is certainly true. But they must then use those receipts to prepare the full accrual-based financial reports that will be essential in making the tough decisions that lie ahead.