- Accrual accounting will strengthen your public financial management

- It is more accurate, comprehensive and transparent

- It requires you to account for transactions in different ways and at different times

- Take time to plan carefully before making the move

- A staged approach will be more successful than trying to change everything at once…

- …but don’t stay in your hybrid phase for too long

What’s the difference between cash and accrual accounting?

Cash accounting is focused on receipts and payments of cash whereas accrual accounting is based on the premise that income, expenses and related asset and liability accounts reflect underlying transactions or economic events.

Under cash accounting just one financial statement is required – the statement of receipts and payments. Accrual accounting, however, requires at least three:

- the statement of financial performance

- the statement of financial position

- and the statement of cash flows.

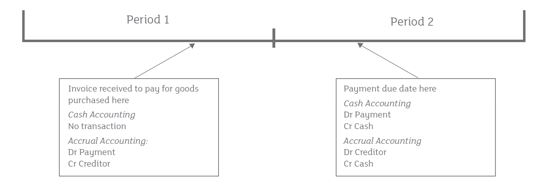

Among the practical changes involved is the processing of transactions in different ways and sometimes at different times (see graphic below), since revenues and expenses will now be recognised for the accounting period. The changes that receipts and payments make to cash balances is shown separately when the related cash transfer is made.

The figure below demonstrates the difference between cash and accrual accounting in terms of which accounting period transactions are recorded in:

What are the advantages of accrual accounting over cash accounting?

While more complex than cash accounting, accounts prepared on an accrual basis are considered to be more reliable, accurate and comprehensive. They also help improve transparency and accountability for citizens and taxpayers.

Under the cash system, governments tend not to maintain up-to-date records of the values of their assets and liabilities. This lets them transfer assets (like land) and liabilities (like pension payments) to third parties without disclosing the financial implications for the government and taxpayer. Accrual-based accounts help focus attention on the acquisition and disposal of government assets, liabilities and contingent liabilities.

International Public Sector Accounting Standards (IPSAS) are accrual-based and governments around the world are increasingly moving to adopt them, particularly in the wake of financial and sovereign debt crises which underscored the need for better financial reporting by governments.

Should we try to change everything at once?

However you approach the shift from cash to accrual accounting, make sure you take the time to plan and prepare carefully.

We find that, in practice, a staged approach to implementation tends to be more successful than a ‘big bang’ approach. You will need to decide what transaction types you transition first and the timing of associated transitions.

Taking a staged approach will mean there will be a period when you are accounting on a hybrid basis: neither entirely accruals nor entirely cash. This is fine, and to be expected. However, it’s important that you don’t stick in this hybrid phase for too long – it’s not supposed to be a permanent solution. Entities are strongly encouraged to make sure they progress to full accrual accounting.

How long will it take?

How quickly you can make the change will depend on lots of different things such as the level of resource you have to take the project forward, how skilled your staff are, how complex your entity’s operations are and the documentation available: is it accurate and comprehensive and, crucially, does it even exist?

Five years might be a reasonable timeframe to adopt for transition, and CIPFA has produced guidance based on a five-year model, but you can expand or contract this timeframe to suit your circumstances.

- What are the key differences between cash and accrual accounting?

- What are the advantages to using accruals?

- If you are planning to move to accrual accounting, what are the important things to think about and plan for?

Further information