From April, the digital services tax will introduce a 2% levy on revenues of social media services, online marketplaces and search engines, and the Office of Budget Responsibility projects will raise £280m in its first year.

“Something has to be done, and until more comprehensive reform happens the government is going to continue to lose billions of pounds,” said George Turner, director of think-tank Taxwatch.

“The DST – imperfect as it might be – ensures that some of that money is not lost.”

But the US views such taxes as discriminatory against American companies.

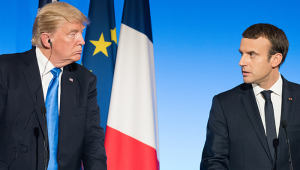

When France introduced its own DST, Donald Trump’s government threatened to put tariffs on French cheese, wine and designer handbags before the French government agreed to delay the tax.

And in January, US treasury secretary Steven Mnuchin told then-chancellor Sajid Javid that if the UK went ahead with the tax he could expect tariffs to be put on British car companies.

The UK government first announced the tax in 2018, arguing that large digital businesses do not pay enough tax, despite making huge revenues.

Since then, countries around the world have been working with the OECD to reform the global system of corporation tax, which has become increasingly viewed as outdated for allowing large multinationals to get away with paying very little in many territories they trade in.

“There was huge pressure on the government to drop it, but that would have been a problem,” Turner said.

“It would have meant the UK government had given in to bullying by the US, and it would have totally removed the pressure on the US to keep going with the OECD process if all they had to do was threaten other governments.”

The UK’s DST will eventually be replaced by the OECD's solution, if consensus is reached. In the meantime, the US has said it will continue to engage with the process.