-

14 Jul 23

New technical work has brought a long-awaited solution for taxing giant digital companies forward, the OECD has said, but progress has been far slower than first hoped – and trade tensions are on the...

-

12 Jul 22

Officials at the OECD have set a deadline of this time next year for global agreement on one part of its landmark tax reforms, agreed in principle by the vast majority of the world’s countries last...

-

2 Jul 21

A “historic” agreement on corporation tax between 130 countries and territories will increase global public revenues by around $150bn according to the OECD, which led the negotiations.

-

4 Jun 21

A global agreement on taxing large digital companies is “within reach”, according to European finance ministers commenting ahead of a G7 meeting.

-

18 May 21

The UK is hesitant to support the US push for a 21% global minimum corporation tax rate over fears doing so would harm the chance of sorting out the issue of digital taxation, it has been reported.

-

30 Apr 21

A decade of austerity means a new era of higher taxes could loom for some governments picking up the pieces after Covid-19.

-

30 Mar 21

The US is preparing to retaliate over six countries’ digital taxes because they “discriminate” against American companies.

-

29 Jan 21

The new US administration is likely to cooperate with other countries in finding a solution to the issues around international corporation tax, German finance minister Olaf Scholz has said.

-

8 Jan 21

Tariffs on French goods such as champagne, cheese and designer handbags will not be imposed by the US government as planned this week – a move that was intended as retaliation against France’s...

-

12 Oct 20

Global efforts to reform the way giant digital businesses are taxed will stretch into 2021, after political differences and Covid-19 slowed negotiations.

-

19 Jun 20

Global talks aimed at creating an international tax system able to deal with huge multinational digital companies such as Facebook and Amazon will continue without the US, after it pulled out of...

-

5 Jun 20

The US government has taken a step towards introducing tariffs to retaliate against digital taxes on ‘internet giants’ that are being pursued by several other countries as well as the European Union.

-

20 May 20

Indonesia is set to impose a 10% digital services tax on companies based overseas in the second half of 2020, as the government scrambles to fight the economic impact of the Covid-19 pandemic.

-

5 May 20

Efforts to fix the perceived problems posed by big digital businesses to the global tax system remain on track despite the Covid-19 pandemic, the OECD has said.

-

26 Mar 20

The jury is still out on whether OECD talks will succeed in introducing a global digital tax for multinational firms such as Google, Apple, Facebook and Amazon

-

12 Mar 20

The UK government risks retaliation from the US after confirming it will go ahead with its planned tax on internet giants such as Facebook and Google from April.

-

21 Jan 20

France and the US “will work together” to avoid a trade war over the French decision to introduce a digital tax last summer, Emmanuel Macron has said.

-

6 Jan 20

France will retaliate if the US imposes tariffs on its cheese and champagne, the country’s finance minister has warned.

-

3 Dec 19

The US is likely to hit France with new tariffs on products including cheese and champagne to retaliate against the European country’s tax on ‘internet giants’, such as Google and Facebook.

-

28 Nov 19

The US is preparing to announce whether authorities plan to take any action in response to a French tax on internet giants, such as Google and Facebook.

-

27 Nov 19

The international community has had “unprecedented success” fighting offshore tax evasion in the last 10 years, the OECD has said.

-

19 Nov 19

The Czech government has approved a digital tax bill, which will introduce a 7% levy on huge corporations, such as the internet giants of Google and Facebook.

-

27 Aug 19

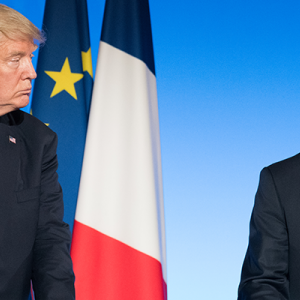

Emmanuel Macron and Donald Trump reached a compromise regarding France’s new tax on tech giants at the meeting of the G7 over the weekend.